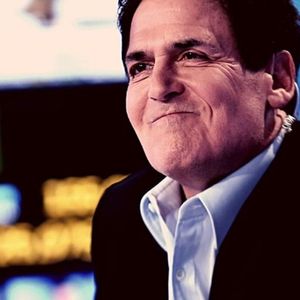

Outspoken billionaire investor and entrepreneur Mark Cuban has launched a scathing attack on the SEC and its handling of complaints against cryptocurrency exchanges, especially Coinbase. Cuban was highly critical of the lack of support for companies actively looking to comply with securities regulations in the country. Cuban Frustrated With SEC Approach Billionaire Mark Cuban has long advocated for cryptocurrencies and recently expressed his frustration with the United States Securities and Exchange Commission (SEC) and its approach to crypto. Cuban stated that the Securities and Exchange Commission could have adopted a much clearer approach for compliance, and avoided legal disputes altogether. Cuban tweeted, “The SEC could have easily have gone to them and outlined an exact plan to get them to compliance. Then if @coinbase or whoever didn’t comply, they sue over whatever legal disagreements they have. Instead, they do what they told one of my companies to do when we called, read these cases and get a lawyer to figure it out for you.” SEC Only Wants To Litigate Cuban also stated that the SEC is full of lawyers, and all lawyers want to do is litigate. He added that there would be greater compliance if there were more business people within the SEC. “They are full of lawyers. Lawyers want to litigate. If you had business people, more like the SBA, there would be more compliance, fewer lawsuits, and better investor education and protections. But if that happened, 2k SEC lawyers would be out of a job.” The billionaire also suggested that the SEC promotes the cases and wins as metrics instead of keeping track of the number of companies that they help reach compliance. No One Trusts The SEC Cuban further argued that the SEC’s approach was fermenting a climate of fear and mistrust, leading to companies fearing to engage with the regulator because they are afraid of potential legal ramifications. This would make it harder for companies to achieve compliance, going against the SEC’s mandate of protecting investors and maintaining efficient markets. “As it is, no one wants to talk to the SEC because no one trusts them for fear of being in the same situation as Coinbase finds itself. You get what you measure.” Repercussions Of The SEC Crackdown The lawsuit against Coinbase came just after a similar complaint was filed against Binance and its CEO, Changpeng Zhao. The crackdown reflects an increasingly hostile regulatory environment for crypto companies in the United States. It has also led to a number of trading pairs being delisted from Binance.US. The SEC has been going after crypto companies following the collapse of FTX under the pretext of protecting consumers. Coinbase Pushes Back Coinbase has also pushed back against the SEC and has demanded clearer guidance from the chief financial regulator. Brian Armstrong, CEO of Coinbase, stated that the agency needs to clearly define what constitutes a security, leading to greater uncertainty and potentially hindering innovation in the crypto space. The SEC has stated that everything other than Bitcoin is a security. However, Armstrong has contended that the law says differently and that regulators around the globe are taking a different position than that of the SEC. Armstrong stated in an interview that Coinbase also met with the SEC, “We met with the SEC 30 times in the last year. They never gave us a single piece of feedback about what we could be doing better. We just got silence.” The US Court of Appeals for the Third Circuit has ordered the SEC to respond within a week. The SEC had sued Coinbase for allegedly acting as an unregistered broker, as it goes after some of the biggest names in crypto over alleged violations of US securities laws. “Since at least 2019, Coinbase has made billions of dollars unlawfully facilitating the buying and selling of crypto asset securities. Coinbase intertwines the traditional services of an exchange, broker, and clearing agency without having registered any of those functions with the Commission as required by law.” Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.