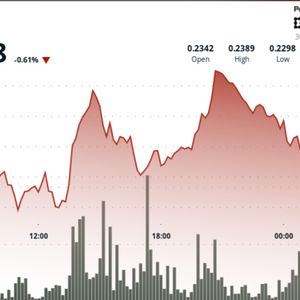

Solana ($SOL) has experienced a dynamic trading session as whales aggressively adjust their positions. Today, a single whale reportedly sold $31.59 million in $SOL, highlighting significant profit-taking on minor price pumps, according to analyst TedPillows. Despite this selling pressure, the market shows potential for continued upside if key technical levels hold. Weekly Chart Hints at Bullish Continuation According to CryptoJelleNL, Solana’s weekly chart shows a prominent cup-and-handle pattern forming above $180 support. The recent bounce near $206 confirms a successful retest of the breakout zone. The $250 mark remains the last hurdle for buyers, and clearing this resistance could trigger a sustained rally toward $300–$340 by year-end. Source: X Conversely, a failure to overcome $250 may result in a brief pullback toward $190–$200 before another attempt. Consequently, the current setup signals bullish continuation if buyers can defend the retest and push decisively through this key resistance. Daily Chart Insights and Liquidity Sweeps On the daily timeframe, Solana has reclaimed the 50-day simple moving average (SMA) after a brief dip, signaling renewed bullish interest, according to Umair Crypto. The recent sweep below the SMA likely gathered liquidity, setting up a potential move toward resistance around $229–$232. Source: X Nevertheless, traders remain cautious, as weekend closes often spark debates about the validity of short-term movements. A confirmed close above $210 would strengthen the bullish outlook, while slipping back under the SMA could target support levels at $185 and $161. The RSI has recovered from oversold conditions but remains mid-range, suggesting measured buying interest. With the current price around $214 , $SOL has gained 3.56% in the past 24 hours, despite a 1.24% decline over the last week. Trading volumes remain robust, with $7.31 billion exchanged in the last 24 hours, reflecting active investor engagement. Regulatory Updates Add Another Layer Beyond technical factors, regulatory news continues to influence sentiment. Journalist Eleanor Terrett reports that the SEC has asked issuers of $SOL, $LTC, $XRP, $ADA, and $DOGE ETFs to withdraw their 19b-4 filings following the approval of generic listing standards. Withdrawals could begin this week, removing some previous regulatory hurdles for crypto ETFs .