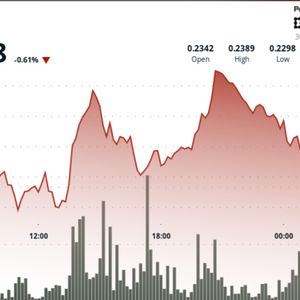

ETH has staged a weekend recovery back above $4,000, revealing underlying strength and fuelling bullish Ethereum price predictions . The altcoin found unexpected support at $3800, flipping a past resistance zone into support despite historical demand zones eyeing a floor much lower. Three support levels to watch for Ethereum $ETH : $3,515, $3,020, and $2,772. pic.twitter.com/M6UiTUGvjz — Ali (@ali_charts) September 27, 2025 On-chain metrics had placed the next price floor at $3,515, with the UTXO Realized Price Distribution (URPD) pointing to a high volume of positions previously taken at that level. This break from past market behavior signals a potential shift in sentiment, with buyers stepping in at higher psychological levels rather than following previous buying activity. Confidence is building across the market, a sentiment echoed by Sentroa, reporting continued exchange outflows alongside last week’s price decline. Despite negative price performance, exchange outflows remained strong for both ETH and BTC, indicating accumulation across the market pic.twitter.com/eAqZTk6Vof — Sentora (previously IntoTheBlock) (@SentoraHQ) September 26, 2025 When holders move their coins to self-custody, it suggests a shift to HODLing and accumulation, a testament to a longer-term bullish outlook. Ethereum Price Predictions: What’s Got The Market So Bullish? This conviction follows a strong confluence of support, with the lower boundary of a 2-month brewing bull flag pattern aligning with a broader ascending channel at $3,800. The setup has created a launchpad, flipping to level from past resistance to support as momentum indicators turned bullish. The RSI has sharply recovered from the oversold threshold at 30, often marking a bottom as sellers exhaust and buyers step in. Meanwhile, the MACD histogram is approaching the signal line in a potential golden cross, suggesting this bounce could mark the start of a lasting uptrend. The $4,500 level stands as the key threshold for a bull flag breakout. If fully realised, the pattern targets a new all-time high at $5,560 and a retest of the broader ascending channel. With a breakout here too, the Ethereum price could extend towards $8,000 , representing nearly a 100% gain from current levels. With stacking catalysts like U.S. interest rate cuts and new staking ETH ETFs attracting inflows, this setup could be realised before year-end. A breakdown below $3,800, however, could set sights back on past accumulation zones. A 15% fall to $3,500 could be the next floor. Bitcoin Could Outpace Ethereum With a Next-Gen Layer-2 As attention floods into the altcoin market, Bitcoin is quietly preparing a major comeback by addressing its biggest limitation: ecosystem expansion. Bitcoin Hyper ($HYPER) is bridging Bitcoin’s security and stability with Solana’s speed , creating a new Layer-2 network that unlocks scalable, efficient use cases previously out of reach. Bitcoin Hyper presale website. For years, slow transactions, high fees, and limited programmability have capped Bitcoin’s potential. $HYPER removes those limits—just as the market enters a bullish phase. Some analysts are eyeing a $250,000 BTC this cycle, and with $HYPER positioned at the center of Bitcoin’s ecosystem expansion, it could capture that momentum. With almost $19 million raised already , the project is taking off. But the opportunity is still early; even a fraction of Bitcoin’s trading volume could still deliver exponential upside. You can secure Bitcoin Hyper ($HYPER) now on the official website before exchange listings amplify demand. The next presale price increase is just hours away. To keep up with Bitcoin Hyper, follow them on X (formerly Twitter) and Telegram . Visit the Official Website Here The post Ethereum Price Prediction: Surprise Bounce Recovers $4,000 – On-Chain Signals Point to Greater Gains appeared first on Cryptonews .