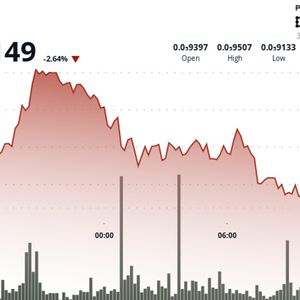

Predictive Oncology digital asset treasury announced a $344.4 million allocation centered on Aethir’s ATH token, making it the first Nasdaq-listed company to record DePIN tokens as a balance-sheet asset and directly tie token value to decentralized GPU infrastructure. First Nasdaq-listed DePIN treasury: Predictive Oncology records ATH tokens on its balance sheet. Structure: two concurrent PIPEs combining cash and in-kind ATH contributions advised by DNA Fund and placed by BTIG. Market impact: ATH trading under $0.06 with ~ $2.3B market cap and 24‑hour volume up ~330% (CoinMarketCap). Predictive Oncology digital asset treasury: $344.4M ATH token allocation recorded as a balance-sheet asset; read implications and next steps. Learn more. The cancer research company has adopted a digital asset treasury model centered on decentralized physical infrastructure networks. Predictive Oncology (POAI), a biotechnology firm focused on AI-driven cancer research, announced a $344.4 million digital asset treasury anchored in Aethir’s ATH token. The company will hold and actively manage tokens tied to a Decentralized Physical Infrastructure Network (DePIN), marking a novel treasury model for a Nasdaq‑listed issuer. The capital strategy was created with DNA Fund as advisor and BTIG as placement agent. The transaction was executed as two concurrent private investments in public equity (PIPEs), combining a cash PIPE and a crypto PIPE that accepted in‑kind ATH token contributions, according to company disclosures and DNA Fund commentary. Aethir (ATH) token price. Source: CoinMarketCap What is Predictive Oncology’s digital asset treasury? Predictive Oncology digital asset treasury is a $344.4 million reserve composed primarily of ATH tokens that the company will record as a balance-sheet asset tied to Aethir’s decentralized GPU infrastructure. This hybrid financing links traditional equity capital with tokenized DePIN infrastructure assets. How does the ATH token back Aethir’s DePIN infrastructure? ATH is Aethir’s native token for coordinating and accessing decentralized GPU resources. Aethir operates a decentralized cloud network that allocates physical GPU compute for AI, high-performance computing and gaming workloads. ATH traded under $0.06 with an approximate market capitalization of $2.3 billion and a 24‑hour trading volume surge of roughly 330% on CoinMarketCap after the announcement. Why does this matter for investors and corporate treasuries? Front-loading exposure to DePIN tokens allows firms to position balance sheets for emerging infrastructure tokenization. Predictive Oncology’s move signals a trend where microcap and small‑cap issuers use crypto PIPEs to access new capital structures while recording tokenized infrastructure as assets that could appreciate with network adoption. What were Predictive Oncology’s recent financials and corporate moves? Before the treasury announcement, Predictive Oncology traded as a microcap with limited revenue. The company reported $2,682 in revenue for Q2 2025 and $110,310 in Q1 2025, with quarterly net losses exceeding $2 million. Earlier in 2025, the company divested its Skyline Medical division and used an at‑the‑market facility to raise roughly $586,000 to support operations. How did markets react to the ATH treasury announcement? Shares jumped more than 70% on the announcement day, reaching a level not seen since March. ATH’s trading activity and price moved sharply higher following news of the ATH allocation. Comparable corporate pivots by small public companies into crypto treasuries—such as name changes and ETH accumulation by other issuers—contributed to an investor reappraisal of cyclically risky microcap names. Predictive Oncology (POIA) stock price. Source: Yahoo Finance Analysts at Standard Chartered have warned that widespread adoption of digital asset treasury strategies may compress market net asset values (mNAVs), which measure enterprise value relative to crypto holdings. Standard Chartered noted market saturation as a primary driver of mNAV compression. The largest digital asset treasury (DAT) companies have experienced mNAV compression in recent months. Source: Standard Chartered Frequently Asked Questions Can a Nasdaq-listed company legally hold tokens on its balance sheet? Yes. Public companies can hold digital assets as treasury assets if they account for them according to applicable accounting guidance and disclose holdings transparently. Predictive Oncology has structured its ATH allocation through PIPE transactions and public disclosures to reflect the asset on its balance sheet. How will ATH holdings be valued on Predictive Oncology’s books? Valuation will depend on company accounting policy and prevailing guidance for digital assets. Companies often use fair value measurement approaches, and volatility in token markets can materially affect reported asset values and mNAV calculations. What risks should investors consider with digital asset treasuries? Key risks include token price volatility, liquidity constraints, regulatory uncertainty, and potential mNAV compression if many firms adopt similar strategies. Analysts cite market saturation among DATs as a downside risk to valuations. { "@context": "https://schema.org", "@type": "NewsArticle", "headline": "Predictive Oncology digital asset treasury: $344.4M ATH allocation", "image": ["https://en.coinotag.com/wp-content/uploads/2025/09/0199961a-bc54-7a3b-9e82-c0011d03ad85.png"], "datePublished": "2025-09-29T12:00:00Z", "dateModified": "2025-09-29T12:00:00Z", "author": { "@type": "Organization", "name": "COINOTAG" }, "publisher": { "@type": "Organization", "name": "COINOTAG", "logo": { "@type": "ImageObject", "url": "https://en.coinotag.com/assets/logo.png" } }, "mainEntityOfPage": { "@type": "WebPage", "@id": "https://en.coinotag.com/article/predictive-oncology-ath-treasury" }, "description": "Predictive Oncology has allocated $344.4M in ATH tokens to create a DePIN‑backed digital asset treasury that will be recorded on the company balance sheet."} { "@context": "https://schema.org", "@type": "FAQPage", "mainEntity": [ { "@type": "Question", "name": "Can a Nasdaq-listed company legally hold tokens on its balance sheet?", "acceptedAnswer": { "@type": "Answer", "text": "Yes. Public companies can hold digital assets as treasury assets if they account for them according to applicable accounting guidance and disclose holdings transparently." } }, { "@type": "Question", "name": "How will ATH holdings be valued on Predictive Oncology’s books?", "acceptedAnswer": { "@type": "Answer", "text": "Valuation will depend on the company's accounting policy and fair value measurement; token volatility can materially affect reported asset values and mNAV ratios." } }, { "@type": "Question", "name": "What are the primary risks of digital asset treasury strategies?", "acceptedAnswer": { "@type": "Answer", "text": "Primary risks include token price volatility, liquidity issues, regulatory changes, and potential mNAV compression as more companies adopt similar treasury models." } } ]} { "@context": "https://schema.org", "@type": "HowTo", "name": "How to read a digital asset treasury announcement", "description": "Steps to assess a corporate digital asset treasury announcement and its implications for valuation and operations.", "step": [ { "@type": "HowToStep", "name": "Confirm transaction structure", "text": "Identify whether the deal is cash, crypto in‑kind, or a hybrid, and note placement agents and advisors." }, { "@type": "HowToStep", "name": "Assess accounting treatment", "text": "Determine how the company will value and report tokens on the balance sheet under applicable accounting guidance." }, { "@type": "HowToStep", "name": "Evaluate market and liquidity impact", "text": "Review token market cap, trading volume changes, and analyst commentary on mNAV and valuation risks." } ]} Key Takeaways Novel treasury model : Predictive Oncology records ATH tokens as a balance-sheet DePIN asset under a $344.4M program. Market response : ATH price action and the company’s stock rallied sharply after the announcement, reflecting investor interest. Risks and oversight : mNAV compression, token volatility and accounting treatment remain primary investor concerns; monitor disclosures closely. Conclusion Predictive Oncology’s pivot to a digital asset treasury centered on the ATH token signals a new hybrid financing pathway linking Nasdaq-listed equity to DePIN infrastructure. Investors should weigh potential upside from network adoption against valuation and accounting risks. Expect continued scrutiny of disclosures and mNAV trends as the sector evolves.