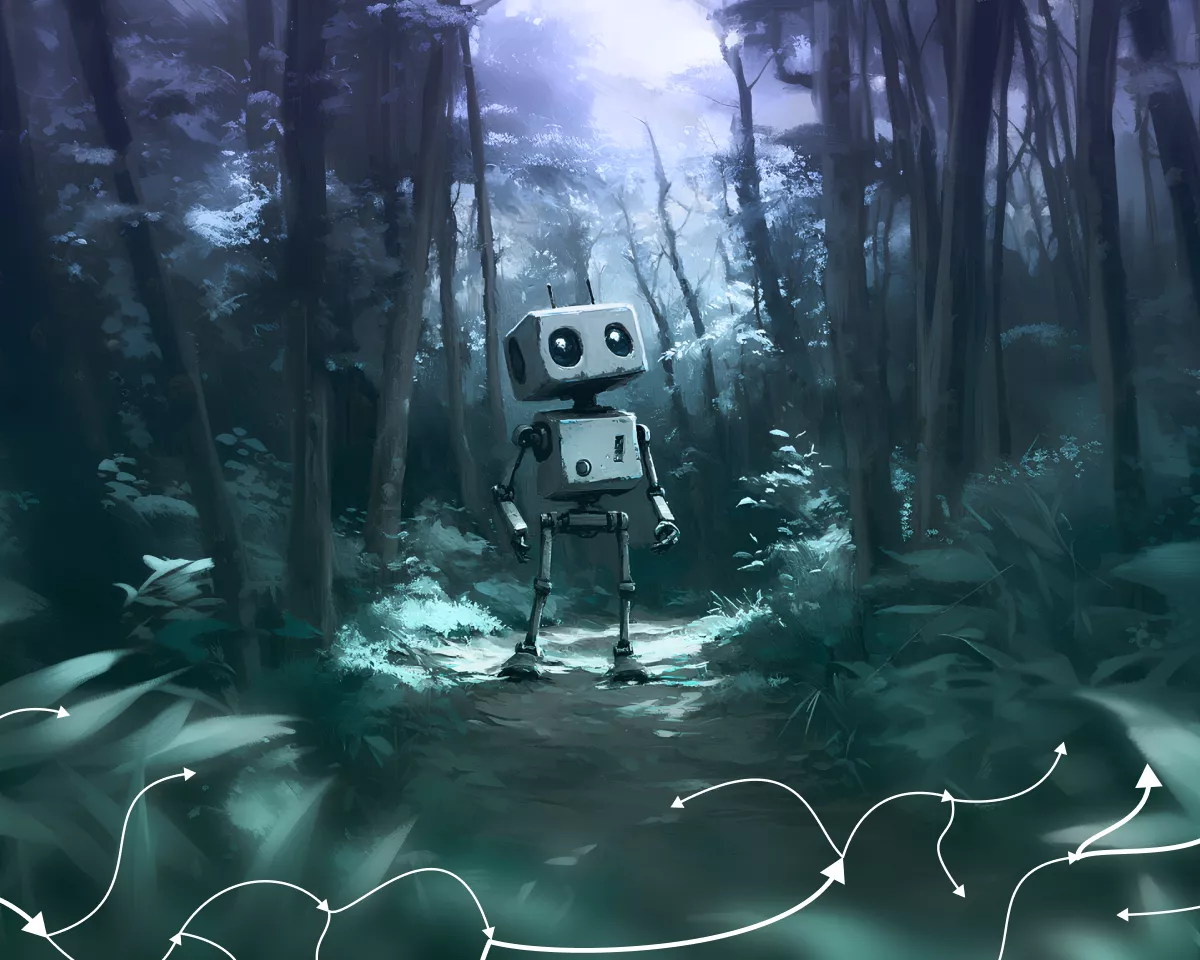

Summary The XRP-SEC lawsuit continues, with XRP scoring a win. The key of the matter remains whether XRP is a security or just digital code. Despite the chaos surrounding XRP, the technical chart looks good to me. Overview The long-lasting legal brawl between the US Securities and Exchange Commission (SEC) and Ripple Labs, the firm behind the popular cryptocurrency XRP ( XRP-USD ), has taken interesting turns over time. Regulators, interested parties, and the crypto community have waited for more than two years to hear the final verdict. The outcome of the lawsuit is considered an important factor in determining the future of crypto regulation and giving a clearer picture of where securities laws apply in crypto token offerings. Analysts and top crypto lawyers suggest that a summary judgment ruling may be imminent. SEC's Motion Denied Yet Again In the course of the SEC-vs-Ripple legal battle, several motions filed by the SEC have been denied by the courts . The SEC had earlier filed a motion, in December 2022, to block Ripple Labs from having access to compiled documents related to the controversial June 2018 speech made by SEC's former Corporation Finance director William Hinman at the Yahoo Finance All Markets Summit. The Hinman Speech Documents, which the SEC had sought to seal, are made up of internal emails, memos, text messages, and expert opinions that followed the Hinman 2018 speech, in which Hinman stated: Putting aside the fundraising that accompanied the creation of Ether, based on my understanding of the present state of Ether, the Ethereum network, and its decentralized structure, current offers and sales of Ether are not securities transactions. Source: William Hinman The SEC has called the controversial speech "Hinman's own opinion, which does not represent the opinion of the SEC." The SEC has long argued that the Hinman Speech Documents are irrelevant to the case and should be sealed; however, Judge Analisa Torres, on May 16, denied the SEC's motion to seal the documents, meaning the documents will eventually be made public. Top Lawyers Weigh In Based on analysis by top crypto lawyers, the next logical step to follow Judge Torres' denial of the SEC's motion to seal the Hinman documents will be for both parties - the SEC and Ripple Labs - to reach an agreement on how and when the Hinman documents will be released. A notable Australian-based and pro-XRP lawyer, Attorney Bill Morgan, has asserted that XRP cannot be deemed a security by the SEC. Attorney Morgan hinted at the fact that Ripple Labs has transitioned from institutional sales of XRP to sales to On-Demand Liquidity (ODL) clients. The attorney said XRP use in ODL does not satisfy any of the elements of the Howey Test. Attorney John Deaton, the founder of CryptoLaw, weighed in on the probable outcome of the lawsuit. Deaton pointed to the 2018 Hinman speech, calling it a speech that has a lot of input from top SEC officials to be called Hinman's personal opinion. According to Attorney Deaton, the Hinman Speech Documents comprise a total of 63 emails and 52 unique drafts from top SEC officials, which he calls "a lot for a personal opinion." Attorney Fred Rispoli, the founder of HODL Law, a law firm dedicated to the unique issues of digital assets and cryptocurrencies, believes that Ripple Labs has a better chance of winning the case against the SEC. He also believes that a summary judgment ruling is near. He shared his insights in an interview with Tony Edward of the Thinking Crypto podcast. Expensive Lawsuit According to a CNBC news report, Brad Garlinghouse, CEO of Ripple Labs, revealed to CNBC's Dan Murphy in a fireside chat at the Dubai Fintech Summit that by the end of the legal brawl with the SEC, Ripple Labs will have spent $200 million. ...by the time all's said and done, we will have spent $200 million defending ourselves against a lawsuit, which from its very beginning, people were like, well, this doesn't make a lot of sense, Source: Garlinghouse, CNBC report. Crypto Tokens Can Evolve We have witnessed instances when a crypto coin or token supposedly transitions from being a security to a non-security. Polkadot, for example, is one of the tokens that have made this transition, according to the Web3 Foundation. In a Twitter thread posted on January 26, the Web3 Foundation announced that the Polkadot's native coin DOT ( DOT-USD ) had morphed into a non-security. So what is token morphing and how does a token go through this process? The DAO report, published in July 2017, made it clear that basically every token used for fundraising a blockchain project is highly likely to be a security in the eyes of @SECGov, this meant the @SECGov was likely to view the DOT token itself as a security, at least initially. But at the same time, the SEC also indicated that any given token could lose its characteristic as a security over time, and no longer be a security (aka to "morph")," Source: Twitter Using a similar argument, Attorney John Deaton asserted in a Twitter thread , published earlier this year, that XRP remains a "digital code" even if it was sold as an investment contract. Technical Analysis As the Ripple and SEC legal battle continues, Ripple has been gaining traction, with the price making convincing moves off its low. XRP TA (Author's work) XRP reached a bottom just below 30 cents back in June 2022 and since almost doubled in price at its peak, though we are now back at around 47 cents. This retracement, which I have been expecting, has given us a perfect opportunity to go long. We retraced at the 50% extension of wave iii, exactly where you'd expect wave iv to land. We have then witnessed an impulsive move off the lows, and we should now be in a wave v to end the larger degree wave 3. The target for this wave would be somewhere around 70-86 cents. This is the 1.618 ext of wave 1 measured from the bottom of wave 2. Takeaway The legal battle between the SEC and Ripple Labs regarding XRP has attracted significant attention and has important implications for crypto regulation. The case could influence the future classification of cryptocurrencies. Ultimately, the outcome of the Ripple-SEC lawsuit will have far-reaching implications for the crypto industry and the clarity of regulations surrounding digital assets. In the more immediate term, I see a good chance here to buy XRP before we have a significant rally.