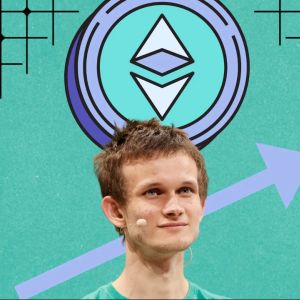

Bitcoin ( BTC-USD ) advanced to the highest level seen since the end of May in Tuesday afternoon trading on news last week that asset management giant BlackRock ( BLK ) filed paperwork to create a spot bitcoin exchange-traded fund. Despite risk-off action taking hold across traditional markets, the world's largest digital token by market cap ( BTC-USD ) rose 4.2% to $27.77K at 1:57 p.m. ET. Ethereum ( ETH-USD ) was also trading in the green, drifting up 2.2% to $1.76K. The bullish price action comes as BlackRock's ( BLK ) bet on bitcoin ( BTC-USD ) "shows Bitcoin continues to be an asset of interest for some of the world’s largest financial institutions," CF Benchmarks CEO Sui Chung said in a statement this past week. “An estimated 20% of Americans have now owned bitcoin at some point," he added. "BlackRock’s proposed ETF potentially offers the other 80% an option that is altogether more familiar and accessible.” Note that this isn't BlackRock's ( BLK ) first foray into the crypto space. The company last August unveiled its first-ever private trust offering direct BTC exposure to its U.S.-based institutional clients. Shortly before that, it teamed up with crypto exchange Coinbase Global ( COIN ) to provide institutional clients access to direct BTC trading capabilities. The BLK ETF filing also helped to repair the discount on Grayscale Bitcoin Trust's ( OTC:GBTC ) share price relative to net asset value, narrowing to the lowest level since last September at around 33%. GBTC shares gapped up 8.8% at the time of writing. Crypto-exposed stocks on the move include: Iris Energy ( IREN ), +22.8% , Hut 8 Mining ( HUT ), +18.3% , Bit Digital ( BTBT ), +14% , Marathon Digital ( MARA ), +11.1% , and HIVE Blockchain ( HIVE ), +10.4% . More on the Crypto Market EDX Markets launches digital asset market; closes new financing round Crypto funds log minor outflows in past week - report Bitcoin: New Fantasy Despite Summer Lull And Uncertainties (Technical Analysis)