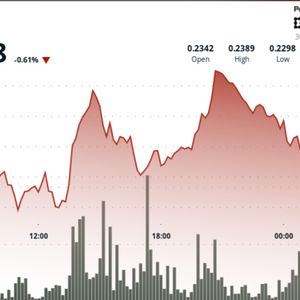

Ethereum price is poised for a record quarterly close above $3,700, signaling a confirmed breakout that targets $6,400 if the multi-month “W” structure holds. Key resistance bands at $4,158–$4,505 must be cleared to retest the $4,950 high and sustain a longer-term move toward $6,000+ ETH nears highest-ever quarterly close above $3,700 — breakout targets $6,400. Immediate resistance clusters: $4,158, $4,307, $4,505; clearing them opens all-time high retest. 24h volume ~$27.2B; market cap ~$497.8B; circulating supply ~120.7M ETH — supportive liquidity. Ethereum price update: ETH nears record Q3 close above $3,700 — read the resistance levels, targets, and trading outlook. Stay informed with COINOTAG analysis. What is Ethereum’s Q3 outlook? Ethereum price is approaching a potential record quarterly close above $3,700, which would confirm a multi-month breakout and point to aggressive upside targets of $6,000–$6,400 if momentum continues. Short-term resistance near $4,158–$4,505 must be overcome to validate the next leg higher. How do resistance levels influence Ethereum’s next move? Ethereum faces stacked resistance at $4,158, $4,307 and $4,505, identified by realized-price distributions and past heavy buying. Overcoming these zones would remove selling pressure and allow ETH to challenge the all-time high near $4,950. Volume, RSI divergence, and trendline breakout increase the probability of a decisive move. Ethereum approaches record Q3 close above $3,700, with breakout patterns targeting $6,400 and resistance levels near $4,158–$4,505. Ethereum nears record quarterly close above $3,700, with breakout patterns signaling a $6,400 target. Key resistance zones remain at $4,158, $4,307, and $4,505 before price can retest the $4,950 high. Ethereum shows signs of entering an expansion phase, with long-term projections pointing toward $6,000. If ETH closes above $3,700 this quarter, it would mark the highest quarterly close on record. Only two days remained before the Q3 candle closed in the referenced analysis. Chart patterns indicate that a confirmed breakout of the classic “W” structure points toward a longer-term target near $6,400. Why does the price structure matter for Ethereum? Longer timeframe chart structure shows Ethereum cleared long-term resistance near $3,000 after multiple failed attempts in 2022. The stronger momentum and sustained breakout increase the odds of a multi-quarter expansion phase. Technical confirmation on volume and momentum indicators supports this view. #Ethereum Highest Quarter in History? If #ETH closes above $3,700, this would mark the highest quarterly close ever. Only 2 days left until the Q3 candle closes. If confirmed, the W structure breakout points to a target around $6,400. — Titan of Crypto (Twitter), September 28, 2025 Ethereum traded at $4,124.29, recording a 3.1 percent gain within 24 hours, according to CoinGecko data. The intraday range ran between $3,971.15 and $4,141.84, reflecting steady upside momentum. Market capitalization reached approximately $497.8 billion, with circulating supply around 120.7 million ETH. Source: AliCharts (X) Additional resistance levels were identified using realized-price distribution and on-chain liquidity heatmaps (Glassnode, plain text reference). These zones reflect prior heavy buying where sellers may look to exit at breakeven. Clearing these levels is a prerequisite for an all-time high retest near $4,950. How is trading activity supporting the move? Trading volume remains robust, with a reported 24-hour volume of about $27.2 billion, indicating strong market participation. ETH also strengthened versus BTC, trading near 0.03678 BTC per ETH. The combination of volume and momentum suggests market participants are accumulating into the breakout. Source: ZYN (X) ZYN’s pattern analysis indicates Ethereum has moved through accumulation and manipulation phases and is now in expansion. ZYN’s projection places a plausible $6,000 target by November 2025 if the expansion sustains. Technical indicators—bullish RSI divergence and trendline break—support a continuation scenario. Frequently Asked Questions What are the immediate resistance levels for Ethereum? Immediate resistance levels are $4,158, $4,307 and $4,505. These bands correspond to prior high-volume buy zones where selling pressure could emerge; clearing them is key to challenging $4,950. When would a long-term target of $6,400 become realistic? If Ethereum confirms a quarterly close above $3,700 and sustains higher-volume rallies while holding trendline support, the technical “W” breakout would make $6,400 a realistic long-term target over subsequent quarters. Key Takeaways Quarterly close matters : A close above $3,700 would be the highest quarterly finish for ETH and validate the breakout. Major resistance bands : $4,158–$4,505 must be cleared to retest highs; volume will confirm strength. Targets and timeline : Short-term targets range to $4,950; extended patterns point toward $6,000–$6,400 if momentum holds. Conclusion Ethereum’s near-term outlook is bullish conditional on a confirmed quarterly close above $3,700 and successive break of resistance bands at $4,158–$4,505. Technical and on-chain signals support an expansion phase, with possible targets from $4,950 up to $6,400 over the next quarters. Monitor volume and trendline support for trade confirmation. { "@context": "https://schema.org", "@type": "NewsArticle", "headline": "Ethereum Nears Record Quarterly Close Above $3,700; Breakout Targets $6,400", "alternativeHeadline": "ETH approaches highest quarterly close with resistance at $4,158–$4,505", "image": ["https://en.coinotag.com/wp-content/uploads/2025/09/image-410.png"], "datePublished": "2025-09-30T08:00:00Z", "dateModified": "2025-09-30T08:00:00Z", "author": { "@type": "Organization", "name": "COINOTAG" }, "publisher": { "@type": "Organization", "name": "COINOTAG", "logo": { "@type": "ImageObject", "url": "https://en.coinotag.com/wp-content/uploads/2024/01/coinotag-logo.png" } }, "mainEntityOfPage": { "@type": "WebPage", "@id": "https://en.coinotag.com/articles/ethereum-q3-2025-close" }, "description": "Ethereum nears a record quarterly close above $3,700; technical patterns target $6,400 with resistance near $4,158–$4,505. Read levels, volume and market outlook."} { "@context": "https://schema.org", "@type": "FAQPage", "mainEntity": [ { "@type": "Question", "name": "What are the immediate resistance levels for Ethereum?", "acceptedAnswer": { "@type": "Answer", "text": "Immediate resistance levels are $4,158, $4,307 and $4,505; clearing them is necessary to retest the $4,950 high." } }, { "@type": "Question", "name": "When does a $6,400 target become realistic for ETH?", "acceptedAnswer": { "@type": "Answer", "text": "A $6,400 target becomes realistic following a confirmed quarterly close above $3,700 and sustained momentum that validates the multi-month breakout structure." } } ]} { "@context": "https://schema.org", "@type": "HowTo", "name": "How to interpret an Ethereum breakout", "description": "Step-by-step method to assess an ETH breakout and potential targets.", "step": [ { "@type": "HowToStep", "name": "Confirm the quarterly close", "text": "Verify ETH closes above $3,700 on the quarterly candle to validate the breakout." }, { "@type": "HowToStep", "name": "Check volume and momentum", "text": "Confirm rising volume and bullish RSI divergence to ensure momentum supports the move." }, { "@type": "HowToStep", "name": "Monitor resistance bands", "text": "Watch $4,158, $4,307 and $4,505; a decisive break clears the path to $4,950 and higher targets." } ]} Published: 2025-09-30 · Updated: 2025-09-30 · Author: COINOTAG