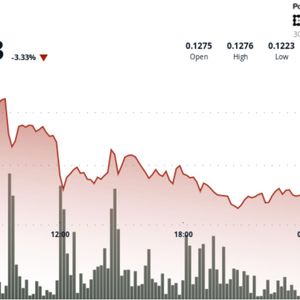

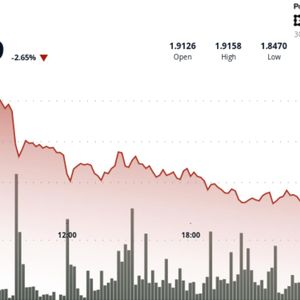

Analysts and crypto enthusiasts are exploring the potential price of XRP if it were to attain a market capitalization comparable to silver, which recently surpassed a $4.48 trillion valuation. Despite a strong performance for precious metals this year, XRP has struggled since October 2025, reflecting broader weakness across the cryptocurrency market. Silver’s Strong 2025 Performance Silver (XAG) has been one of the top-performing assets globally in 2025, even outpacing gold (XAU) in terms of annual gains. Starting the year at $28.95, silver has surged 174% to $79 per ounce at the time of writing. This growth, combined with its total supply of approximately 1.751 million metric tonnes, has pushed silver’s market capitalization to a record $4.485 trillion. While silver has captured investor attention, XRP has underperformed during the same period, falling from $2.07 at the start of the year to $1.87 at present, a decline of over 12%. XRP as Digital Silver Within the crypto community, XRP has often been referred to as “digital silver,” reflecting its potential for value preservation and transactional utility. Advocates argue that this characterization implies a capacity for substantial growth, drawing parallels with silver’s market trajectory. Jake Molter of Molt Media highlighted that many investors previously overlooked silver, only to rush into the market as prices climbed. He suggested that XRP could experience a similar dynamic if it begins to attract mainstream attention. Market analyst Steph also noted patterns reminiscent of precious metals’ movements, including extended consolidation phases, which may indicate potential for a future uptrend in XRP. We are on X, follow us to connect with us :- @TimesTabloid1 — TimesTabloid (@TimesTabloid1) June 15, 2025 Price Implications of a $4.48 Trillion Market Cap Currently, XRP’s circulating supply stands at 60.57 billion tokens, giving the crypto asset a market capitalization of approximately $111.99 billion. This is down from a peak of $216.69 billion in July 2025, reflecting a loss of over $104 billion. If XRP were to reach a market capitalization equal to silver’s $4.485 trillion, its price per token would rise to roughly $74. This represents a gain of 3,857% from its current level, demonstrating the significant upside potential implied by such a valuation. While the comparison with silver illustrates an extreme upside scenario, it is contingent on widespread adoption, investor interest, and regulatory clarity. XRP’s potential to achieve such a market cap relies on long-term structural growth within the cryptocurrency sector, institutional participation, and expanded use in cross-border payments and settlement systems. The “digital silver” narrative continues to influence both community sentiment and speculative projections. However, analysts caution that while matching silver’s market cap provides a useful framework for estimating potential price ceilings, practical market dynamics may prevent such rapid appreciation. Although XRP’s current market performance lags behind silver’s gains, the comparison highlights the token’s theoretical upside. For investors, the $74 target serves as a reference point for long-term planning, emphasizing the importance of adoption, liquidity, and market confidence in determining XRP’s future valuation. Disclaimer : This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses. Follow us on Twitter , Facebook , Telegram , and Google News The post XRP Price Outlook if It Matches Silver’s $4.48 Trillion Market Cap appeared first on Times Tabloid .

![[LIVE] Crypto News Today: Latest Updates for Dec. 30, 2025 – Bitcoin Fails to Hold $90K as Broad Crypto Sell-Off Deepens [LIVE] Crypto News Today: Latest Updates for Dec. 30, 2025 – Bitcoin Fails to Hold $90K as Broad Crypto Sell-Off Deepens](https://resources.cryptocompare.com/news/52/56575554.jpeg)